Loading

Get Rrb 1099 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rrb 1099 Form online

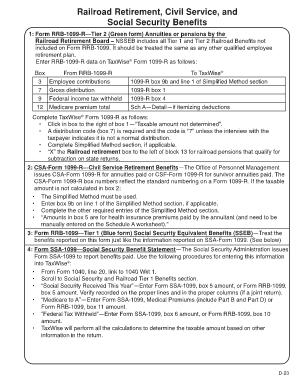

The Rrb 1099 Form is essential for reporting railroad retirement, civil service, and Social Security benefits. This guide will provide clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the Rrb 1099 Form online.

- Click ‘Get Form’ button to access the Rrb 1099 Form and open it in your editor.

- Begin by entering the total gross distribution in the appropriate field. Ensure that this amount reflects all Tier 1 and Tier 2 Railroad Benefits as required.

- Next, input any employee contributions in the specified box, ensuring accuracy in reporting.

- Record the federal income tax withheld in the designated section of the form to comply with tax regulations.

- Complete the Medicare premium total field, if applicable, to provide a full picture of your financial situation.

- Review your entries for correctness, particularly focusing on the required codes and amounts as mandated for proper reporting.

- Upon completing all fields, choose to save your changes. You can also opt to download, print, or share the Rrb 1099 Form as needed.

Start completing your documents online for a streamlined process.

You'll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you'll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy – Copy B—to your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.