Loading

Get St 389

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 389 online

The St 389 form is essential for reporting various local sales and use taxes to ensure compliance with county and municipality regulations. This guide provides a comprehensive, step-by-step approach to completing the form online, tailored for users of all experience levels.

Follow the steps to effectively complete the St 389 form online.

- Click the ‘Get Form’ button to access the St 389 form and open it in your chosen editor.

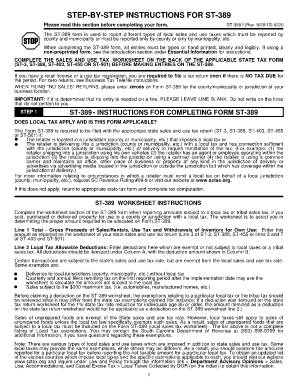

- Begin by reviewing the essential information section. Complete the sales and use tax worksheet on the back of your applicable state tax form (ST-3, ST-388, ST-403, ST-455, or ST-501) to gather necessary data before making entries on the St 389 form.

- Fill out all required sections, ensuring that all entries are typed or hand printed clearly. If you do not have a pre-printed form, input your business name, address, retail license or registration number, and the relevant tax period as shown on your state tax form.

- Complete the net taxable amounts in Column A by entering gross proceeds of sales, use tax, and withdrawals of inventory for your own use. Refer to the worksheet for the amounts to report.

- Report allowable deductions in Column B, itemizing each deduction under Column A and entering the deduction amount in Column B.

- Calculate net sales and purchases by subtracting total deductions from the total gross sales. This amount goes in Line 4.

- If local option taxes apply, proceed to the relevant sections, listing each jurisdiction and local tax amount due correctly, using the provided codes from the form.

- Conclude by ensuring that all entries across multiple pages are accurate, summing total amounts due, penalties, and interest where applicable, and recording these totals as instructed.

- After completing the form, make sure to save changes, download a copy for your records, and print if necessary, before submitting.

Complete your St 389 form online today to ensure compliance and streamline your tax reporting process.

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.