Loading

Get 592v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 592v online

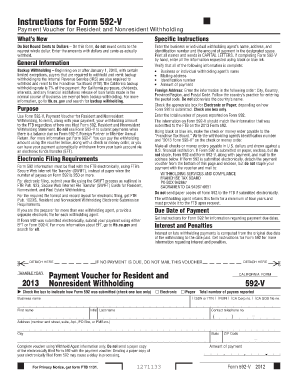

This guide provides clear instructions on how to fill out Form 592-V, the Payment Voucher for Resident and Nonresident Withholding. Whether you are a business or individual, following these steps will help ensure your form is completed accurately and submitted correctly.

Follow the steps to complete Form 592-V online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter the business or individual withholding agent’s name in capital letters, ensuring accurate spelling.

- Provide the mailing address, entering details in the following order: Street, City, State, and ZIP Code. Include any suite or apartment number as necessary.

- Input the identification number, which can be a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Federal Employer Identification Number (FEIN), California Corporation Number, or California Secretary of State File Number.

- Fill in the amount of payment. Ensure you do not round the cents; input the exact amount in dollars and cents.

- Indicate how Form 592 was submitted by checking the appropriate box for either Electronic or Paper submission. Remember to select only one option.

- Enter the total number of payees reported on Form 592, confirming that this aligns with the submitted information.

- If applicable, follow the instructions for payment submission, such as preparing a check or money order payable to the Franchise Tax Board. Write the withholding agent's identification number and '2013 Form 592-V' on the payment.

- Once all fields are accurately filled, save changes, and then you may download, print, or share the completed form for your records.

Take the next step and complete your documents online today.

A. Purpose. Use Form 592 to report the total withholding under California Revenue and Taxation Code (R&TC) Sections 18662 and 18664. ... Backup withholding supersedes all types of withholding. Form 592 is also used to report withholding payments for a resident payee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.