Loading

Get Form 8903

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8903 online

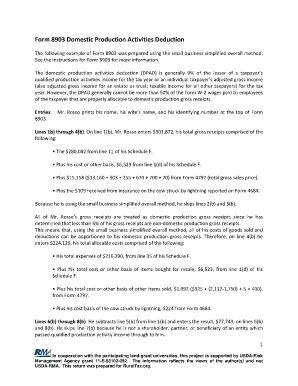

Filling out Form 8903 online can seem daunting, but with clear guidance, you can navigate it with confidence. This form allows taxpayers to claim the domestic production activities deduction, and understanding each section is crucial for accurate submission.

Follow the steps to successfully complete the Form 8903 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- At the top of Form 8903, enter your name, the name of your partner, and your identifying number as required.

- On line 1(b), enter your total gross receipts. This should include amounts from applicable schedules and forms, as detailed in the instruction guidelines.

- If using the small business simplified overall method, you can skip lines 2(b) and 3(b). Proceed to line 4(b) and input your total allocable costs considering all applicable deductions.

- For lines 6(b) through 8(b), calculate and enter the result from subtracting line 5(b) from line 1(b), and continue to line 10(b) with this amount.

- On line 11(b), complete the calculation for adjusted gross income without the domestic production activities deduction by using the relevant entries from Form 1040.

- Enter the smaller value from line 10(b) or line 11(b) on line 12(b). Proceed with calculating 9% of this amount and enter it on line 13(b).

- Skip line 14(b) and enter the calculated deduction from line 15(b) down to line 22(b), ensuring you take the lesser of line 15(b) or half of line 21(b).

- Finish by confirming all entered values and standards are correct, then save changes or download, print, or share the completed form as needed.

Complete your documents online to ensure accurate and timely submissions.

Using Form 8903 After calculating all of the applicable limitations to your deduction, on line 25 you'll arrive at your allowable domestic production activities tax deduction. For most taxpayers, that amount will transfer to either line 35 of Form 1040 for individuals or line 25 of Form 1120 for corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.