Loading

Get P 941 City Of Pontiac 2q Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P 941 City Of Pontiac 2q Form online

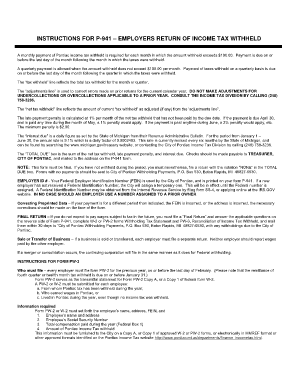

Filing the P 941 City Of Pontiac 2q Form online is a straightforward process that allows employers to report income tax withheld efficiently. This guide provides step-by-step instructions to help users complete the form accurately and submit it on time.

Follow the steps to fill out the P 941 City Of Pontiac 2q Form online.

- Click ‘Get Form’ button to access and open the P 941 City Of Pontiac 2q Form in the appropriate editor.

- Begin by entering your Employer ID number (FEIN) as preprinted on the form. Ensure this number is accurate, as it is essential for your submission.

- Review the 'tax withheld' line. Input the total amount of income tax that was withheld during the specified month or quarter.

- If there were any errors in previous submissions, use the 'adjustments line' to correct them for the current calendar year. Do not include adjustments for prior year undercollections or overcollections.

- Calculate the 'net tax withheld' by adjusting the current ‘tax withheld’ amount with any corrections made in the previous step.

- If applicable, calculate any late payment penalties based on the net tax withheld. The penalty rate is 1% for each month the payment is late.

- Determine the 'interest due' based on the guidelines provided by the State of Michigan, applying the daily factor as necessary.

- Sum the net tax withheld, any late payment penalties, and interest due to arrive at the total amount due. Enter this amount in the 'TOTAL DUE' box.

- If applicable, indicate any 'Final Return' by answering the necessary questions on the reverse side of the form and make sure to complete W-2 or PW-2 forms.

- Review all information for accuracy and completeness, then proceed to save your changes. You can then download, print, or share the completed form as needed.

Complete your P 941 City Of Pontiac 2q Form online to ensure timely and accurate reporting of income tax withheld.

Every corporation doing business in the City of Pontiac, whether or not it has an office or place of business in the city or net profit, is required to file a City of Pontiac Income Tax Corporation Return, Form P-1120.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.