Loading

Get 39 All Filers Must Enter Tax Period: Beginning Legal Name Of Corporation Ending Employer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 39 All Filers Must Enter Tax Period: Beginning Legal Name Of Corporation Ending Employer online

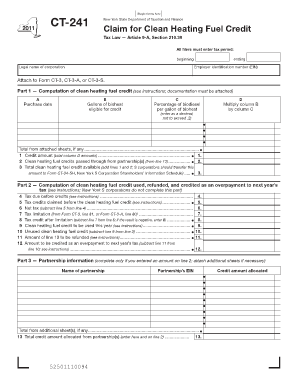

This guide provides a comprehensive overview of how to effectively complete the 39 All Filers Must Enter Tax Period form for the Claim for Clean Heating Fuel Credit. It aims to assist users with varying levels of experience in navigating the online filing process with clarity and ease.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your designated online editor.

- In the first section, enter the tax period. This includes entering the beginning and ending dates clearly to establish the timeframe for the credit claim.

- Provide the legal name of your corporation in the designated field. Ensure that the name matches the official registration documents.

- Enter the Employer Identification Number (EIN). This number uniquely identifies your corporation for tax purposes.

- In Part 1, document the computations for the clean heating fuel credit. Include the purchase date for each bioheat acquisition.

- Record the gallons of bioheat eligible for credit. Make sure to have supporting documentation ready.

- Indicate the percentage of biodiesel per gallon of bioheat purchased, entering this value as a decimal not to exceed .2.

- Calculate the total for column D by multiplying the gallons by the percentage entered in the previous step.

- Continue to complete the remaining calculations in Part 1 by following the instructions for lines 1 through 3, ensuring all detail like total credits passed through from partnerships are accurately reported.

- Proceed to Part 2, if applicable, to compute the clean heating fuel credits used, refunded, and any overpayment credit for next year’s tax.

- For partnerships, if applicable, complete Part 3 with the partnership's information.

- Once all sections are completed, save the changes made to the form and prepare for downloading, printing, or sharing as needed.

Start filling out the necessary documents online today to ensure compliance and maximize your clean heating fuel credit.

Corporations that fail to timely file an income tax return are subject to a penalty of five percent of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25 percent of the unpaid tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.