Loading

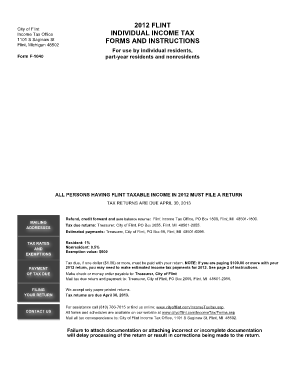

Get City Of Flint Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Flint Tax Forms online

Completing your City of Flint tax forms online can streamline the filing process and ensure that your information is accurately submitted. This guide provides detailed, step-by-step instructions tailored to assist users of all experience levels in filling out the forms effectively.

Follow the steps to fill out the City Of Flint Tax Forms online.

- Press the ‘Get Form’ button to acquire the City of Flint tax form and open it in your preferred editor.

- Begin by entering your name, address, and Social Security number. Ensure that your Social Security number matches the one on your W-2 forms attached to your tax return.

- Indicate your filing status by selecting the appropriate box. If you are filing jointly, include your partner’s name and Social Security number.

- Declare your residency status. Mark the box that applies: Resident, Nonresident, or Part-Year Resident, based on your living situation throughout the year.

- Provide details about your total income. This includes wages, salaries, and any other sources of income. Ensure you document any exclusions and total deductions appropriately.

- Calculate your taxable income by using the provided lines for additions and deductions. Follow the instructions carefully to compute your total taxable income.

- Determine the tax due by applying the appropriate tax rate to your taxable income and enter this figure on the designated line.

- List all payments and credits, including any tax withheld, and total these amounts to identify if you owe tax or receive a refund.

- If filing an amended return, mark the return as 'Amended' at the top. Submit supporting documentation for any changes made.

- Review all entries for accuracy, save your changes, and subsequently download, print, or share the completed tax form as needed.

Start completing your City Of Flint Tax Forms online today for a smooth filing experience.

The Internal Revenue Service (IRS) has released a draft of Form 1040, U.S. Individual Income Tax Return. There are several notable changes to the form proposed for the tax year 2020 - the tax return that you'll file in 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.