Loading

Get Ag Td1ab Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ag Td1ab Form online

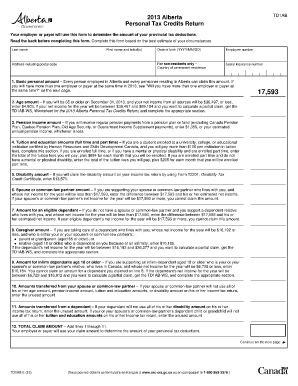

The Ag Td1ab Form is essential for determining the amount of provincial tax deductions for employees and pensioners in Alberta. This guide provides step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete the Ag Td1ab Form online.

- Press the ‘Get Form’ button to obtain the Ag Td1ab Form and open it in your editing tool.

- Begin by entering your last name, first name, and initial(s) in the designated fields. Ensure that your information is correct to avoid any issues.

- Fill in your address, including the postal code, which is necessary for identification and tax purposes.

- Input your date of birth in the format YYYY/MM/DD. This information is crucial for determining eligibility for specific tax credits.

- If you have an employee number, enter it in the corresponding field. This is used by your employer for reference.

- For non-residents, specify your country of permanent residence. This helps in understanding your tax obligations.

- Enter your Social Insurance Number. This number is vital for your identification within the Canadian tax system.

- Complete the applicable sections regarding personal amounts, age amount, pension income amount, and any other relevant tax credits by entering the required information based on your circumstances.

- At the end of the form, calculate the total claim amount by adding all the values from the previous lines, representing your total deductions.

- Finally, review all the entered information for accuracy. Once satisfied, you can save your changes, download, print, or share the completed form.

Complete your Ag Td1ab Form online today to ensure accurate tax deductions.

Step 1: Provide and update your personal information. To save time when you file your return, keep your personal information up-to-date with the CRA. ... Step 2: Report your income. ... Step 3: Claim your deductions, tax credits and expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.