Loading

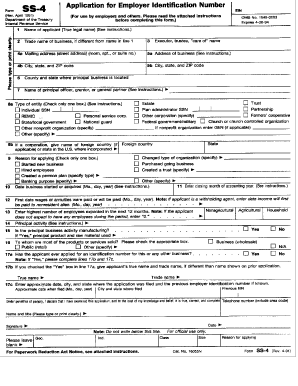

Get Form Ss-4 (rev. 04-1991) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FORM SS-4 (REV. 04-1991) - Internal Revenue Service - IRS online

Filling out the FORM SS-4 is an important step for individuals and organizations seeking to obtain an Employer Identification Number (EIN) from the IRS. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document management tool.

- Begin by entering the legal name of the entity or person applying for the EIN in the designated field. Ensure that the name is spelled correctly as it appears on official documents.

- Next, fill out the trade name, if applicable, which is also referred to as a 'doing business as' name. This should also be accurately represented.

- Indicate the entity type by selecting the appropriate box of the available options such as sole proprietor, corporation, partnership, etc. This is crucial as it determines tax obligations.

- Enter the responsible party's name and social security number in the specified fields. The responsible party is usually the individual who controls, manages, or directs the entity.

- Provide the business address, including street, city, state, and zip code. This address will be used by the IRS for correspondence.

- In the next section, indicate the reason for applying for an EIN. Check the applicable box such as starting a new business or hiring employees.

- Review all the filled-out sections for accuracy. Make any necessary corrections to ensure that all information is complete and correct.

- Once you have confirmed that the form is accurately completed, you can save your changes, download the form, print it, or share it as needed.

Start filling out the FORM SS-4 online today for a smooth EIN application process.

If you have actually lost your SS4 Form, the IRS will not offer you with a copy of your application. However, the IRS will help you acquire another copy of your EIN assignment letter or EIN number. Acquire the EIN from prior business tax returns or from savings account in the corporation's name.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.