Loading

Get 2013 1040cme Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 1040cme Form online

Filing your 2013 1040cme Form online can streamline the process of managing your tax obligations efficiently. This guide will walk you through the essential steps, ensuring that you understand each section and field of the form.

Follow the steps to complete the 2013 1040cme Form accurately.

- Press the ‘Get Form’ button to access the 2013 1040cme Form and open it in your preferred editing tool.

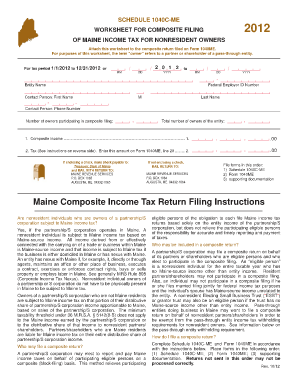

- Enter the tax period dates at the top of the form in the format MM/DD/YYYY. Be sure to fill out the correct year range for the period you are reporting.

- Provide the entity name and federal employer ID number in the designated fields to identify the business associated with the tax filing.

- Fill in the contact person's first name, middle initial, and last name, followed by their phone number to ensure communication regarding the filing.

- Indicate the number of owners participating in the composite filing and the total number of owners for the entity. This information is essential for processing the return correctly.

- Calculate the composite income by summing the positive income amounts for each participating partner or shareholder. Enter this total on line 1.

- Multiply the amount entered on line 1 by 8.5% (0.085) and place the result on line 2. This figure will be transferred to Form 1040ME.

- Complete Form 1040ME, starting with the tax period. Ensure you enter the entity's EIN in the Social Security number format and fill in the entity name as 'Your Last Name.'

- Confirm the filing status by checking the 'Single and Composite Return' and select the 'nonresident' residency status.

- Transfer the composite income from Schedule 1040C-ME, line 1 to line 14 of Form 1040ME.

- Follow through all necessary calculations and information entry as outlined in the instructions for each line of Form 1040ME.

- Review the completed forms to ensure all information is accurate, then save changes, download, print, or share the 2013 1040cme Form as needed.

Start completing your documents online today for a more efficient tax filing experience.

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.