Loading

Get Form 140 Schedule A Itemized Deduction Adjustments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

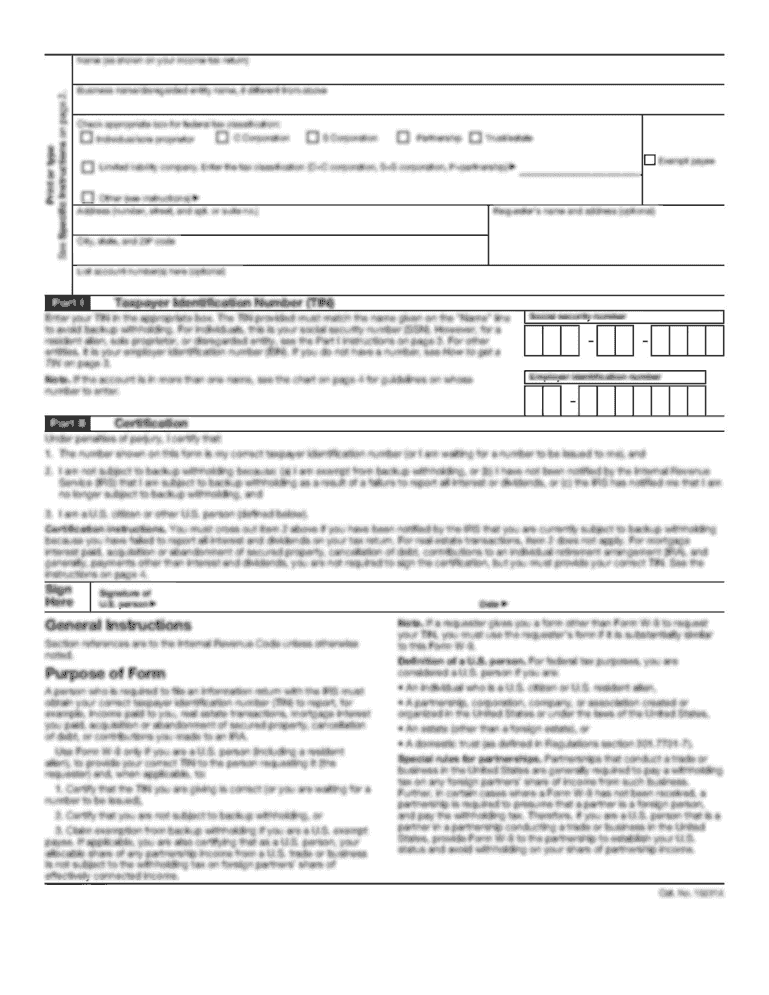

How to fill out the Form 140 Schedule A Itemized Deduction Adjustments online

Filling out the Form 140 Schedule A Itemized Deduction Adjustments online can help you maximize your potential tax deductions. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the form correctly

- Press the ‘Get Form’ button to access the form digitally and open it for editing.

- Begin by providing your personal information, including your name, address, and Social Security number as required in the designated fields.

- Next, assess whether you will itemize your deductions or choose the standard deduction. To qualify for itemizing, ensure that your deductible expenses exceed the 7.5% threshold of your adjusted gross income.

- Document your medical and dental expenses in the appropriate section. Include both out-of-pocket expenses and any unreimbursed payments. Be sure to keep a record of your receipts.

- Input the total medical and dental expenses above the 7.5% threshold. Take care to follow the formatting guidelines provided on the form.

- If applicable, include any necessary state or local tax deductions. Be sure to review your entries to ensure accuracy.

- Once you have filled in all sections, review the form for completeness and accuracy.

- Finally, you may save your changes, download the completed form, print it out for your records, or share it as needed.

Complete your Form 140 Schedule A Itemized Deduction Adjustments online for a smoother tax filing experience.

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.