Loading

Get Sole Proprietorship Financial Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole Proprietorship Financial Statement Form online

Filling out the Sole Proprietorship Financial Statement Form online can seem daunting, but with the right guidance, you can complete it with confidence. This guide will walk you through each section and field of the form, ensuring that you provide all necessary information accurately.

Follow the steps to successfully fill out the Sole Proprietorship Financial Statement Form.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

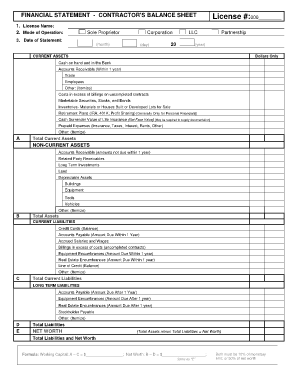

- Begin with the 'License Name' field. Enter the official name under which your business operates.

- For 'Mode of Operation', select 'Sole Proprietor' from the available options.

- Provide the 'Date of Statement' by selecting the appropriate month, day, and year.

- Fill in your 'License #' in the designated field. Ensure this is accurate to avoid any processing delays.

- In the 'Current Assets' section, report your cash on hand and any bank holdings.

- List all accounts receivable that are expected to be collected within one year, including any trade and employee-related amounts.

- Detail any marketable securities, stocks, bonds, and inventories you hold, itemizing each as needed.

- Complete the 'Total Current Assets' by summing all items listed in the section.

- Move to the 'Non-Current Assets' section, detailing receivables due beyond one year, long-term investments, land, depreciable assets, and other holdings.

- Calculate and enter the 'Total Assets' by summing both current and non-current assets.

- In the 'Current Liabilities' portion, report any outstanding credit card balances, accounts payable due within one year, and other short-term liabilities.

- Sum all reported current liabilities to obtain the 'Total Current Liabilities'.

- In the 'Long Term Liabilities' section, provide details of accounts and encumbrances due after one year, along with any other long-term obligations.

- Complete the 'Total Liabilities' field by adding both current and long-term liabilities.

- Calculate your net worth by subtracting total liabilities from total assets, and enter this value in the provided field.

- Review all entered information for accuracy. Ensure that all itemized lists are complete and clearly displayed.

- Once completed, save your changes, and choose to download, print, or share the form as needed.

Start filling out your Sole Proprietorship Financial Statement Form online today!

Related links form

The primary financial statements prepared for a sole proprietorship are the income statement and the balance sheet. Two other statements, the statement of changes in owner's equity and the statement of cash flows, are also often prepared.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.