Loading

Get Affidavit Of Consideration For Use By Buyer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affidavit Of Consideration For Use By Buyer online

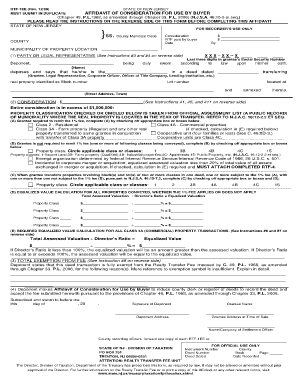

Completing the Affidavit Of Consideration For Use By Buyer is a crucial step in the process of recording a deed in New Jersey. This guide provides clear, step-by-step instructions to ensure that users can fill out the form accurately and effectively, facilitating a smooth online submission experience.

Follow the steps to complete the Affidavit Of Consideration For Use By Buyer.

- Press the ‘Get Form’ button to access the Affidavit Of Consideration For Use By Buyer. This will open the document in your online editor, where you can easily edit the required fields.

- In the first section, fill in the consideration amount that reflects the total money being exchanged for the property. Make sure this aligns with the figure mentioned in the deed.

- Specify the county and municipality where the property is located. This information is essential for proper tracking and record-keeping.

- Input the details of the parties involved—namely, the grantee or their legal representative. Include the grantee’s name and the last three digits of their Social Security Number.

- Clearly describe the details of the property being transferred, including the block and lot numbers, as well as the full street address. Ensure all information is accurate.

- Indicate the classification of the property and check the appropriate boxes according to its classification, as this will affect the realty transfer fee calculations.

- If applicable, complete the exemption section by detailing the reasons for exemption from the Realty Transfer Fee. Provide a thorough explanation.

- Once all sections are completed, review the entries for accuracy. Make any necessary changes before finalizing the document.

- After double-checking your information, you can save your changes, download, print, or share the completed form as needed for submission.

Begin the process of completing your Affidavit Of Consideration For Use By Buyer online today.

The first is between family members. The sale of a property between parent and child, husband and wife, and siblings are exempt. The transfer of a deed from a stepparent to a step-child is only 50% exempt unless the stepparent has adopted that child.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.