Loading

Get St-9a (statement) - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-9A (statement) - Mass.Gov - Mass online

Filling out the ST-9A form is essential for vendors in Massachusetts to report sales and use tax accurately. This guide provides comprehensive instructions to help users complete the form with ease and confidence.

Follow the steps to complete the ST-9A form effectively.

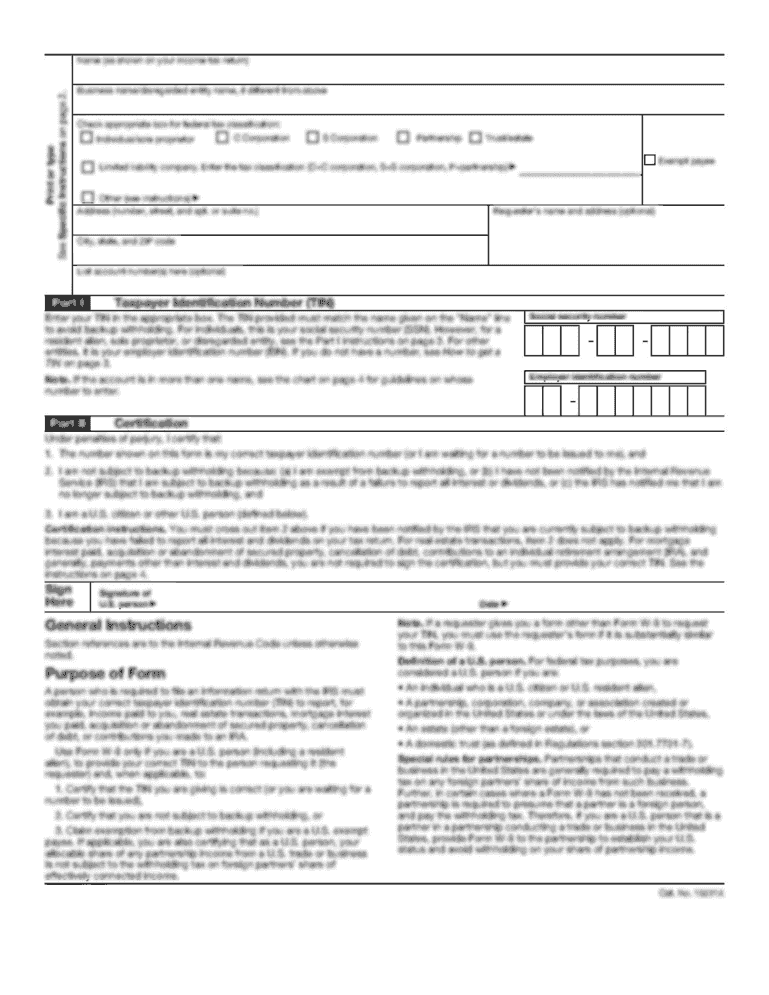

- Click the ‘Get Form’ button to obtain the ST-9A form. This action will allow you to access the document needed for reporting your sales and use tax.

- Enter your federal identification number and business name in the designated fields. Ensure that these details are accurate as they identify your tax account.

- Complete Line 1 by entering the total of all Massachusetts sales, leases, and rentals of tangible personal property. Include all relevant receipts while excluding non-applicable items like cash discounts and taxes collected.

- In Line 2, provide the total of sales for resale and any other exempt sales or adjustments. Make sure to differentiate between types of sales by using the appropriate lines (2A and 2B) for materials and machinery.

- On Line 5, enter the total purchases subject to use tax. This line applies if you have not previously paid a sales tax on the items used.

- Calculate the total taxable amount by adding the figures from Line 4 and Line 5 in Line 6. Then, determine the total taxes due by multiplying Line 6 by 0.0625 (6.25%) in Line 7.

- If you are a tobacco retailer, report the prepaid sales tax amounts on Line 8. Subtract this from the total taxes calculated in Line 7 to get Line 9.

- Complete Line 10 for penalties and interest, if applicable, and then summarize the total amount due or refund in Line 11 by adding Line 9 and Line 10.

- After ensuring all required entries are complete, sign the return, and make any necessary payments. Check that your check is payable to the Commonwealth of Massachusetts before mailing the return to the Massachusetts Department of Revenue.

- Once your form is submitted, you may save changes, download, print, or share the completed ST-9A for your records.

Start filling out your ST-9A form online today for timely and accurate tax filing.

Procedure. In order for a purchase to be exempt from Massachusetts tax, an authorized federal employee must present to the vendor the GSA card with appropriate identification at the time of purchase. A Certificate of Exemption (Form ST-2) and a Sales Tax Exempt Purchaser Certificate (Form ST-5) are not required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.