Loading

Get Arizona Form A-4 - Arizona Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form A-4 - Arizona Department of Revenue online

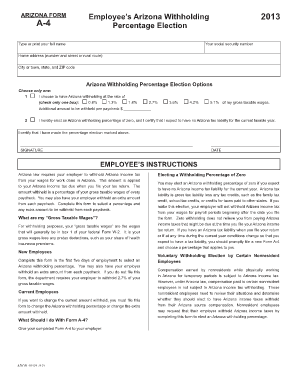

This guide offers expert advice on completing the Arizona Form A-4, which is essential for managing Arizona income tax withholding. By following these steps, users of all legal experience levels can navigate the form online with ease.

Follow the steps to complete your Arizona Form A-4 online

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your full name in the designated field. This ensures that the form is accurately linked to your identity.

- Input your social security number in the corresponding field. Make sure that this information is correct, as it is crucial for identification and tax purposes.

- Provide your home address, including the number and street or rural route, followed by your city, state, and ZIP code. This helps in processing your form effectively.

- Choose your Arizona withholding percentage by selecting only one option from the list provided, which ranges from 0.8% to 5.1%. Ensure that you understand each option's implications before making a selection.

- If you wish to have an additional amount withheld per paycheck, specify that amount in the field provided.

- If you are electing a withholding percentage of zero, ensure you check the appropriate box to certify that you expect to have no Arizona tax liability for the current taxable year.

- Sign and date the form to validate your elections. Your signature serves as confirmation of the accuracy of the information provided.

- After completing the form, save your changes. You can then download, print, or share the form with your employer as necessary.

Complete your Arizona Form A-4 online today to ensure accurate tax withholding.

Total withholding for 2019 will be $4,390. It is rare that an employee would wind up having withholding and a tax liability that match exactly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.