Loading

Get Form M8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M8 online

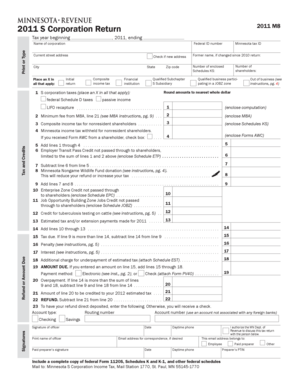

Filling out the Form M8 is an essential part of reporting S corporation taxes. This guide provides clear and detailed instructions to help users complete the form efficiently and accurately online.

Follow the steps to complete the Form M8 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering the tax year at the top of the form, specifying the starting and ending dates of the tax year.

- For additional information, indicate whether this is an initial return, composite income tax, or if the corporation has a former name. If applicable, mark the box for enterprises in a JOBZ zone.

- In the Tax and Credits section, refer to the lines and include any necessary computations, such as LIFO recapture, minimum fee, and composite income tax for nonresident shareholders. Ensure to enclose necessary documents mentioned in the form instructions.

- Complete the Refund or Amount Due section by calculating the total tax due or refund by subtracting lines as instructed. Specify payment methods and include details for electronic payments or checks.

- Sign and date the form in the designated area. If applicable, designate someone to discuss the tax return with the Minnesota Department of Revenue.

Complete your documents online to ensure a smooth filing process.

You can request it by calling the toll-free number on your IRS notice, or your tax professional can call the dedicated tax pro hotline or compliance unit (if applicable) to request FTA for any penalty amount. Learn more about how to handle IRS penalties, or get help from a trusted IRS expert.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.