Loading

Get W2 R Annual Reconciliation Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 R Annual Reconciliation Form 2019 online

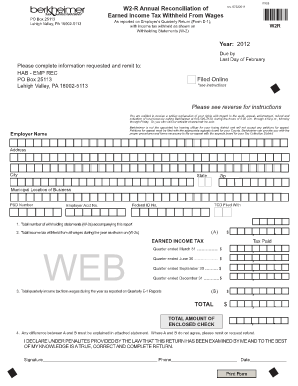

Filing the W2 R Annual Reconciliation Form 2019 is a vital process for reporting earned income tax withheld from wages. This guide aims to provide you with a clear and supportive roadmap to navigate the completion of the form online, ensuring compliance with local tax regulations.

Follow the steps to complete the W2 R form online.

- Click ‘Get Form’ button to procure the W2 R Annual Reconciliation Form 2019 and access it in the designated editor.

- Begin by filling in the employer's name, address, city, state, zip code, municipal location of the business, PSD number, employer account number, and the federal ID number in the provided fields.

- Indicate the total number of withholding statements (W-2s) that accompany this report in line 1 of the form.

- For line 2, enter the total income tax withheld from all wages during the year as shown on the W-2s, breaking it down by quarter: March 31, June 30, September 30, and December 31.

- Complete line 3 by entering the total quarterly income tax from wages as reported on Quarterly E-1 Reports. This is important for comparing with the amounts on line 2.

- If there is a discrepancy between the amounts on line 1 (A) and line 3 (B), provide an explanation in an attached statement as noted on line 4.

- Sign and date the form at the bottom, confirming under penalty of law that the information provided is accurate and complete.

- Once all fields are completed, you can save the changes, download the form, print it, or share it as needed.

Complete your documents online with confidence today.

Taxpayer Annual Local Earned Income Tax Return (CLGS-32-1)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.