Loading

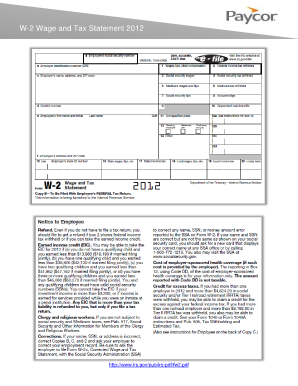

Get Create Fillable 2012 W 2 Tax Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Create Fillable 2012 W-2 Tax Statement Form online

The Create Fillable 2012 W-2 Tax Statement Form is an essential document for reporting wages paid and taxes withheld for employees. This guide will help users fill out the form online with ease and accuracy, ensuring compliance with tax regulations.

Follow the steps to complete the form accurately

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the fields for employee and employer information. Enter the employee's name, address, and Social Security number in the designated sections. Then, provide the employer's name, address, and Employer Identification Number (EIN) as required.

- Complete the wage and tax information. In Box 1, report the employee's total taxable wages for the year. Fill in Box 2 with the federal income tax withheld. Ensure that all amounts are accurate to avoid discrepancies.

- Continue through the sections to report other withheld taxes. Fill out Boxes 3, 4, and 5 for Social Security wages, Social Security tax withheld, and Medicare wages, respectively.

- If applicable, provide additional information in Box 12 for any special compensation or benefits. Use the codes provided in the form to indicate what each amount represents.

- Review all the entered information for accuracy. Verify that names, numbers, and amounts are correct to ensure the form is complete.

- Once all information has been confirmed, users can save their changes, download the completed form, print it, or share it as needed.

Start filling out your tax documents online today for a streamlined process!

Related links form

Yes, you can create a W-2 form for your employees online. Our W-2 generator is perfect for this, as we'll guide you through the steps to make sure you don't miss anything. After answering a few questions, you'll only need to download, print and file filled copy of the form by mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.