Loading

Get Tc 108 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 108 Form online

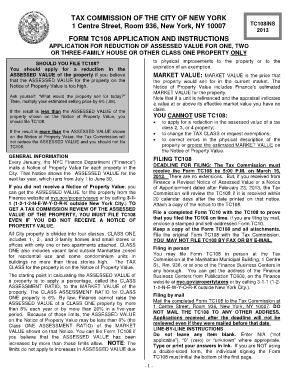

Filling out the Tc 108 Form online can be a straightforward process if you follow the right steps. This guide is designed to help you navigate each section of the form with clarity and confidence, ensuring that you have all the necessary information at hand.

Follow the steps to complete the Tc 108 Form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, enter the block and lot number for the property as indicated on the Notice of Property Value. Ensure that you complete a separate Form TC108 for each lot unless filing for condominium units.

- In Section 2, identify the applicant. The applicant must be a person or entity directly affected by the assessment. If the applicant is not the owner or tenant who pays the taxes, you must also file Form TC200.

- Fill out Section 3 with the applicant's contact information for any necessary follow-up regarding the application.

- In Section 4, provide your estimate of the market value of the property. Ensure you carefully review the calculations to determine if your assessed value is higher than what is justified.

- In Section 5, indicate if you wish to have an in-person hearing or prefer to resolve the case based only on the submitted paperwork.

- Complete Section 6 by describing the property and noting any physical alterations that have occurred since the applicant acquired it.

- In Section 7, provide information on any sale, construction, or refinancing of the property since January 5, 2011. Attach additional documentation if needed.

- If applicable, provide supporting information in Section 8 regarding market value, including sales information or recent appraisals.

- Finally, in Section 9, sign and date the application. Make sure that the person signing is authorized to do so and has personal knowledge of the property.

- After reviewing the completed form, save your changes, print, or share the form as needed for your records before submitting it.

Start filling out the Tc 108 Form online today to ensure you meet the filing deadline.

Who should use this form? Use Form TC101 to protest only the valuation of a property in tax class two or four, including a claim that the statutory limits on annual increases have been exceeded by the Department of Finance for the tax year that will begin on July 1, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.