Loading

Get 2012 It 272 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 IT-272 Form online

Filling out the 2012 IT-272 Form online can be a straightforward process if you follow the right steps. This guide will provide you with clear and concise instructions to ensure you correctly complete the form and maximize your potential tax benefits.

Follow the steps to successfully complete the IT-272 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

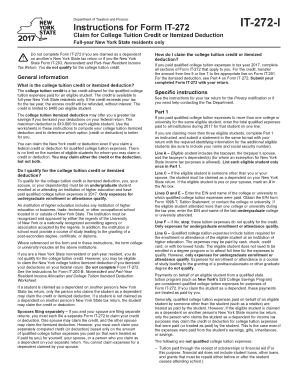

- Review general information about the college tuition credit and itemized deduction. Ensure you understand your eligibility — only full-year New York State residents who are not dependents on someone else's tax return can complete this form.

- Part 1: Enter the total qualified college tuition expenses you paid for each eligible student for the tax year. If claiming expenses for more than three students, attach a statement with the required details.

- For each eligible student, provide their information as needed. Ensure to mark if the student is you or your spouse, as this affects the calculation.

- List the employer identification number (EIN) and the name of each college or university attended. This information is typically found on Form 1098-T, Tuition Statement.

- Confirm that the listed expenses qualify by ensuring they are for undergraduate tuition only and that any scholarships or financial aid received are accounted for.

- In Part 4, if you itemized deductions on your federal return, use the provided worksheets to determine if the itemized deduction or the credit yields a greater tax benefit.

- Once all required fields are filled out, review the completed form for accuracy and completeness.

- Save your changes, and you may then choose to download, print, or share the completed form as required.

Complete your 2012 IT-272 Form online today to maximize your college tuition benefits!

The American Opportunity Tax Credit is based on 100% of the first $2,000 of qualifying college expenses and 25% of the next $2,000, for a maximum possible credit of $2,500 per student. For 2022, you can claim the AOTC for a credit up to $2,500 if: Your student is in their first four years of college.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.