Loading

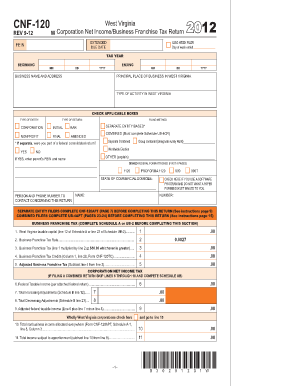

Get Corporate Net Income Tax Forms 2012 - State Of West Virginia - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Corporate Net Income Tax Forms 2012 - State of West Virginia online

This guide provides clear, step-by-step instructions for completing the Corporate Net Income Tax Forms for 2012 for the State of West Virginia. Whether you're familiar with tax forms or not, this resource aims to support you in navigating the requirements to ensure accurate submissions.

Follow the steps to complete the Corporate Net Income Tax Form.

- Press the ‘Get Form’ button to obtain the Corporate Net Income Tax Form and open it in your preferred online editor.

- Fill out the tax year, corporate entity name and address, and federal employer identification number (FEIN) in the designated fields.

- Indicate whether you are filing as a corporation, nonprofit, or other types by checking the appropriate box.

- For the section regarding business activity and filing method, check the applicable boxes and provide information on whether you are a separate or combined report issuer.

- Complete the section for business franchise tax. Input the West Virginia taxable capital and apply the tax rate to calculate the tax owed.

- For the corporation net income tax section, input federal taxable income and detail any total increasing and decreasing adjustments.

- Next, compute the apportioned income for West Virginia and adjust as needed for nonbusiness income allocated to the state.

- Verify that all applicable schedules (A, A-1, A-2, etc.) are completed and attached if required.

- Sign the form, ensuring that the declaration of correctness is completed, and include payment information if applicable.

- Once all sections are complete, save your changes, then download, print, or share the form as required for submission.

Start filling out your Corporate Net Income Tax Forms online today to ensure timely and accurate submissions.

Related links form

To check the status of your West Virginia state refund online, go to https://mytaxes.wvtax.gov/?link=refund. Then, click Search to find your refund. 1-304-558-3333 or 1-800-982-8297.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.