Loading

Get 741 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 741 Form online

Filling out the 741 Form online can streamline the process of submitting your Kentucky fiduciary income tax return. This guide will walk you through each step, ensuring that you complete the form accurately and efficiently.

Follow the steps to fill out the 741 Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

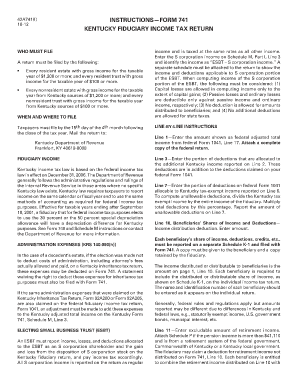

- Begin with the 'Who must file' section. Ensure that you understand whether your estate or trust needs to file based on the gross income thresholds specified for residents and nonresidents.

- Move to the 'When and where to file' section. Note the filing deadline which is the 15th day of the 4th month following the end of the tax year. Make sure to gather any necessary mailing information.

- Fill in 'Fiduciary income' details. Follow the guidelines on reporting income consistent with federal income tax regulations.

- Complete the section on administration expenses. If applicable, include any deductions for costs of administration that were not claimed on an inheritance tax return.

- If electing small business trust (ESBT), report income and deductions allocated to the trust and note S corporation income properly.

- Proceed with the line-by-line instructions provided within the form, starting with Line 1 to report the federal adjusted total income and following through each subsequent line as directed.

- Ensure that all income distributions to beneficiaries are reported accurately on separate Schedule K-1 forms and that you keep appropriate copies for your records.

- Review the penalties and interest sections to understand the implications of late filing or payment, and ensure that you are submitting the form on time.

- After checking for accuracy throughout the form, save your changes, then proceed to download, print, or share the completed 741 Form as needed.

Complete your forms online today for a hassle-free experience!

Fiduciary tax is due on the portion of income from an estate or trust not distributable to beneficiaries. Kentucky's income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax is calculated using a rate of 5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.