Loading

Get Form Pte Wh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pte Wh online

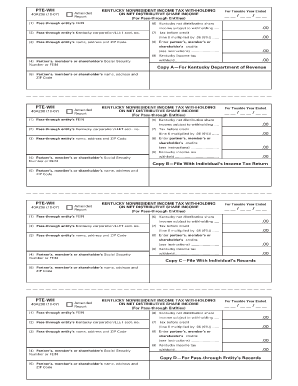

This guide provides clear and detailed instructions on how to complete the Form Pte Wh, which relates to Kentucky nonresident income tax withholding on net distributive share income for pass-through entities. Follow the steps below to accurately fill out this essential form online.

Follow the steps to complete the Form Pte Wh online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter the pass-through entity's federal identification number (FEIN) in field (1). This is a unique number issued by the IRS for tax purposes.

- Provide the pass-through entity's Kentucky corporation or limited liability entity (LLET) account number, if applicable, in field (2). This helps to identify the entity within Kentucky's tax system.

- Fill in the pass-through entity's name, complete address, and ZIP code in field (3). Accurate contact information is crucial for processing.

- Enter the partner’s, member’s, or shareholder’s Social Security number or FEIN in field (4). Ensure this number matches the official documentation to avoid discrepancies.

- In field (5), provide the name, address, and ZIP code of the partner, member, or shareholder. This identifies whose income is being reported.

- Indicate the Kentucky net distributive share income subject to withholding in field (6). Calculate this by combining income and loss items according to the provided instructions, and applying the nonresident percentage.

- Calculate the tax before credits in field (7) by multiplying the net distributive share amount in field (6) by 6 percent (0.06). This will give you the withholding amount.

- In field (8), input any partner's, member's, or shareholder's credits that can reasonably be expected to be claimed during the year.

- Finally, subtract the amount in field (8) from the amount in field (7) in field (9). This is the total Kentucky income tax to be withheld, which must be reported.

- Once all fields are completed, you can save the changes. Then, you have the option to download, print, or share the form as necessary.

Complete your Form Pte Wh online today to ensure compliance with Kentucky tax regulations.

The importance of tax withholding If it turns out you've underpaid, you'll have a tax bill to pay. If you ended up with a huge tax bill this year and don't want another, you can use Form W-4 to increase your tax withholding. That'll help you owe less (or nothing) next year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.