Loading

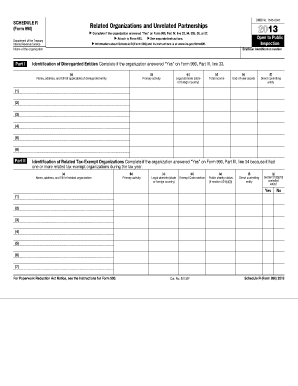

Get 990 Schedule R 2012 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990 Schedule R 2012 Form online

The 990 Schedule R 2012 form is essential for organizations that answer 'Yes' on specific lines of Form 990. This guide will provide you with step-by-step instructions to help you efficiently fill out the form online.

Follow the steps to complete the 990 Schedule R form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin filling in the organization's name and employer identification number (EIN) at the top of the form. This is crucial for identifying your organization within the IRS records.

- In Part I, identify disregarded entities by entering the name, address, and EIN of each disregarded entity, along with their respective primary activities and legal domiciles.

- Move to Part II, where you will list any related tax-exempt organizations. Fill in the required fields including the organization’s name, address, EIN, primary activity, legal domicile, exempt code section, and indicate if it is a controlled entity.

- Part III focuses on related organizations taxable as partnerships. You will need to provide similar details as in Part II, including name, address, EIN, and information about predominant income.

- In Part IV, you will identify related organizations taxable as a corporation or trust, providing details such as type of entity and sections of income relevant to taxation.

- Part V requires you to disclose transactions with related organizations. Mark 'Yes' or 'No' for various transaction types, and if applicable, provide the name of the related organization, transaction type, amount involved, and method of determining the amount.

- Part VI provides space for unrelated organizations taxable as partnerships. Complete this section for partnerships through which your organization conducted significant activities, providing detailed information about each entity.

- Finally, in Part VII, include any supplemental information necessary to clarify your responses throughout the form.

- Once all sections are completed, review your entries for accuracy. You can then save changes, download, print, or share the completed form for your records.

Start completing your 990 Schedule R form online today for a streamlined filing process.

Form 990, Return of Organization Exempt From Income Tax. Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file this form to provide the IRS with the information required by section 6033.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.