Loading

Get Nyc 204 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 204 Instructions online

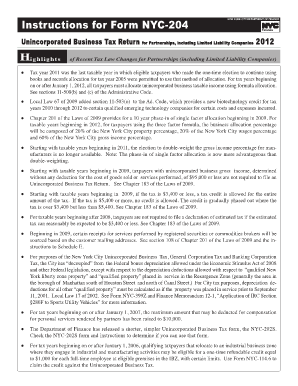

The Nyc 204 Instructions guide individuals and partnerships in completing their Unincorporated Business Tax Return. This guide provides detailed, step-by-step instructions to ensure users can successfully fill out the form online, regardless of their prior experience with legal documents.

Follow the steps to complete the Nyc 204 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the basic information at the top of the form, including the name of the partnership, the Federal Employer Identification Number (FEIN), and the tax year. Ensure accuracy to avoid potential issues.

- In Section A, report the total gross income from all business activities accurately. Remember, gross income should be reported before any deductions for the cost of goods sold or services performed.

- Proceed to calculate the business allocation percentage, which is required if the partnership operates both inside and outside New York City. Use the methodologies defined in the instructions to determine this percentage.

- Fill out Schedule B to report specific items of business income, gain, loss, or deduction. Be sure to attach any relevant federal tax documents as required.

- If applicable, complete Schedule C by listing all partners and their respective shares of income and losses. This is crucial for accurately reporting each partner's involvement in the partnership.

- Review the lines dedicated to deductions, including any unincorporated business net operating loss deductions if applicable. Ensure that all calculations adhere to the guidelines provided in the form instructions.

- Final steps include double-checking all entries for accuracy, finalizing any necessary calculations, and ensuring that attachments are included, especially those referenced throughout the form.

- Once you have confirmed that all details are accurate and complete, you can save changes, download a copy for your records, print the form, or share it as needed.

Complete your Nyc 204 form online today to ensure compliance with tax regulations!

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.