Loading

Get Nc E 536 Webfill

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc E 536 Webfill online

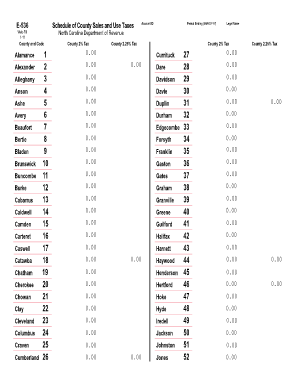

Filling out the Nc E 536 Webfill is an important process for reporting county sales and use taxes in North Carolina. This guide provides a detailed, step-by-step overview to assist users in completing the form accurately and efficiently.

Follow the steps to accurately complete the Nc E 536 Webfill online.

- Click the ‘Get Form’ button to acquire the form and open it in the online editor.

- Enter the period ending date in the specified format (MM-DD-YY) to indicate the reporting period for taxes.

- Fill in the legal name, which is the official name associated with your account for tax purposes.

- Select the county from the list provided, ensuring that you choose the correct county name and code corresponding to your reporting location.

- For each county listed in the sections below, input the appropriate sales and use tax amounts under the columns for County 2% Tax and County 2.25% Tax as applicable.

- At the bottom of the form, calculate and enter the totals for the County 2% Tax and County 2.25% Tax to ensure accuracy in your reporting.

- Once you have completed all necessary fields, review your entries for any errors or omissions.

- Save your changes, and then you can choose to download, print, or share the completed form as required.

Complete your Nc E 536 Webfill form online today to ensure accurate tax reporting.

Form E-536, Schedule of County Sales and Use Taxes (October 2020 - September 2022) | NCDOR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.