Loading

Get Nc Dor Ib 43

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc Dor Ib 43 online

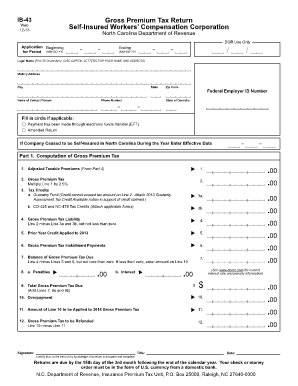

The Nc Dor Ib 43 form is essential for self-insured workers’ compensation corporations in North Carolina to report gross premium tax. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the Nc Dor Ib 43 form online.

- Press the ‘Get Form’ button to access the Nc Dor Ib 43 form and open it in your browser.

- Input the application beginning and ending dates in MM-DD-YY format in the designated fields.

- Enter your legal name in capital letters, ensuring it does not exceed 35 characters. Fill in your mailing address, city, state, and zip code.

- Provide your federal employer identification number, the name of the contact person, their phone number, and the state of domicile.

- If applicable, indicate if payment has been made through electronic funds transfer (EFT) or if this is an amended return. If your company ceased to be self-insured in North Carolina during the year, enter the effective date.

- Proceed to Part 1 and calculate your adjusted taxable premiums from Part 4, entering the result on Line 1.

- Calculate the gross premium tax by multiplying Line 1 by 2.5% and record this on Line 2.

- Claim any applicable tax credits related to the guaranty fund and other forms, entering these amounts on Lines 3a and 3b respectively.

- Compute your gross premium tax liability on Line 4 by subtracting the total credits on Lines 3a and 3b from Line 2.

- Include any prior year credit applied to the current year on Line 5 and any installment payments on Line 6.

- Determine the total balance of gross premium tax due on Line 7 by subtracting Lines 5 and 6 from Line 4.

- Complete any necessary penalties, interest, and total gross premium tax due calculations on subsequent lines.

- In Part 2, repeat similar steps for the computation of the insurance regulatory charge using the results from Part 1.

- After completing all sections, review the form thoroughly to ensure accuracy.

- Once verified, save your changes, and download or print the form for submission.

Begin the process of filling out your Nc Dor Ib 43 form online today.

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499). Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.