Loading

Get 990e Down Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990e Down Form online

This guide provides step-by-step instructions to assist users in completing the 990e Down Form online. Whether you are familiar with digital forms or new to the process, these clear directions will support you in submitting your form efficiently.

Follow the steps to complete the 990e Down Form with ease.

- Click the ‘Get Form’ button to access the form and open it for editing.

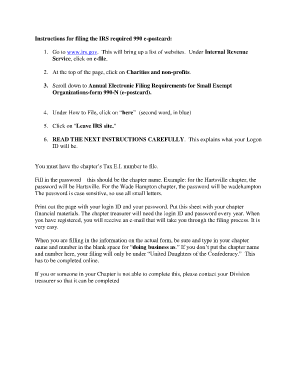

- Visit www.irs.gov and navigate to the e-file section by selecting Charities and Non-profits at the top of the page.

- Scroll down to find the Annual Electronic Filing Requirements for Small Exempt Organizations, and select the form 990-N (e-postcard).

- Under the How to File section, click on the blue link marked ‘here’.

- Choose to Leave IRS site for further instructions.

- Carefully read the instructions for creating your Logon ID. Ensure you have your chapter’s Tax E.I. number ready.

- Enter your password, which should match your chapter name in lowercase letters. For example, if your chapter is Hartsville, type 'hartsville'.

- Print the page containing your login ID and password. Store this document with your chapter financial materials for future reference.

- Complete the form by entering your chapter name and number in the ‘doing business as’ section. This ensures your filing is correctly attributed to your chapter.

- If you encounter any issues, reach out to your Division treasurer for assistance in completing the form.

- After filling out the form, save your changes, and choose to download, print, or share as necessary.

Start filling out the 990e Down Form online today to ensure your compliance.

Form 990-EZ can be filed by organizations with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of their tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.