Loading

Get Il Cr Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CR Instructions online

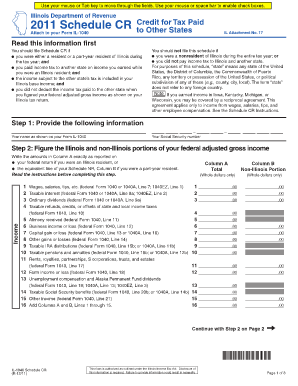

Filling out the IL CR Instructions can be a straightforward process if you follow the guidance provided. This document outlines the necessary steps to accurately complete the form and ensures you properly report any tax paid to other states.

Follow the steps to complete the IL CR Instructions effectively.

- Click the 'Get Form' button to access the IL CR Instructions document and open it in your preferred online editor.

- Enter your name as it appears on your Form IL-1040, followed by your Social Security number in the designated fields.

- Determine the Illinois and non-Illinois portions of your federal adjusted gross income. Carefully input the amounts as reported on your federal return. This includes wages, salaries, tips, and any other sources of income.

- Account for any Illinois additions and subtractions by referencing your Form IL-1040. Input these adjustments in the respective columns, paying close attention to which amounts are sourced from Illinois.

- Calculate your Schedule CR decimal by dividing the non-Illinois portion by the total amount and input the result.

- If applicable, complete the part-year residents section to document income earned during your residency in Illinois.

- Claim your credit for tax paid to any applicable states by checking the appropriate state box and entering the total amount of income tax paid.

- Once all fields are filled out, review your entries for accuracy before saving your changes. You can then download the completed form, print it, or share it as needed.

Begin filling out your documents online today to ensure accuracy and compliance.

Related links form

If you filed your 2021 Form IL-1040 but did not include your Schedule ICR, then to request the property tax rebate, you must complete and submit on or before October 17, 2022, Form IL-1040-PTR, Property Tax Rebate Form. Submit Form IL-1040-PTR electronically through MyTax Illinois or submit a paper Form IL-1040-PTR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.