Loading

Get Bensalem Business Privilege And Mercantile Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bensalem Business Privilege And Mercantile Tax Return online

Filling out the Bensalem Business Privilege And Mercantile Tax Return online can be a straightforward process with the right guidance. This document outlines the necessary steps to help users complete the form accurately and efficiently.

Follow the steps to complete your tax return online

- Click ‘Get Form’ button to access the Bensalem Business Privilege And Mercantile Tax Return form and open it for editing.

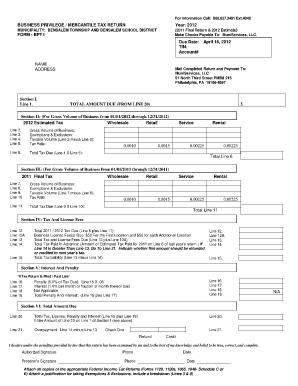

- Enter the tax year and due date at the top of the form. Ensure the correct year is selected, which for this example is 2012.

- Fill in your Tax Identification Number (TIN) and account number. This information is crucial for processing your return.

- Provide your business name and address in the specified fields.

- In Section I, calculate the total amount due from your calculations and enter it in Line 1.

- Proceed to Section II and provide the gross volume of business for the year 2012. Fill in the appropriate figures for wholesale, retail, service, and rental businesses.

- Note any exemptions and exclusions in Line 3. Subtract that amount from Line 2 to calculate your taxable volume, then multiply by the applicable tax rate in Line 5 to find the total tax due.

- Move to Section III for the 2011 final tax information. Repeat the previous steps to fill in the necessary details for that year.

- In Section IV, calculate your total tax and license fees due. Enter the business license fee and any advance payments in their respective lines.

- If applicable, calculate any penalties and interests in Section V, detailing any late payments.

- Finally, review Section VI and complete the total amount due for submission. Make sure to check if there are any overpayments.

- Attach any necessary documentation, such as copies of federal income tax returns, and finalize by signing the authorization section.

- Once all information is verified and filled out, save the changes, and choose to download, print, or share your completed return.

Complete your Bensalem Business Privilege And Mercantile Tax Return online today!

Residents of Bensalem Township are subject to a local tax rate of 1% on earned income beginning January 1, 2016. + Who is responsible for paying the tax? The individual taxpayer is responsible for paying the local earned income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.