Loading

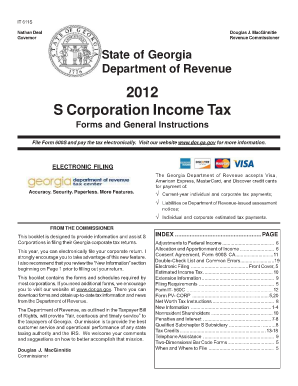

Get Georgia 600s Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia 600s Instructions online

This guide provides clear and supportive instructions for filling out the Georgia 600s Instructions form online. Whether you have some experience with tax forms or this is your first time, you will find step-by-step directions tailored to your needs.

Follow the steps to successfully complete your Georgia 600s Instructions.

- Press the ‘Get Form’ button to access the Georgia 600s Instructions form and open it in your digital editor.

- Begin by entering your corporate name, address, and Federal ID Number at the top of the form. Make sure these details are accurate to avoid any processing delays.

- Indicate the taxable year for which you are filing the return by selecting the appropriate year from the dropdown menu.

- If you have filed for an extension, check the designated box on the form and include a copy of the extension request along with your submission.

- Ensure that you include a complete copy of Federal Form 1120S and any relevant supporting schedules with your Georgia return to maintain compliance.

- Calculate any tax due and make sure to complete the payment voucher (Form PV-CORP) and include it with your return if applicable.

- Review your entries for accuracy. Check that all required fields are completed and that you have not overlooked any additional schedules or forms needed.

- Once you have filled the form, save your changes and download the completed form for your records. You may print it for submission or share it as necessary.

Start completing your Georgia 600s Instructions form online now to ensure timely filing.

Related links form

A number of things could cause a delay in your Georgia refund, including: Paper filed returns. ... The GADOR states that it may take up to 90 business days from the date of receipt to process a return and issue a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.