Get Nyc 200v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 200v online

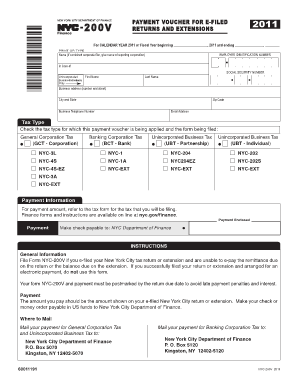

Filling out the Nyc 200v form online is a straightforward process that assists taxpayers in submitting their payments accurately. This guide provides essential steps and tips to ensure your form is completed correctly.

Follow the steps to successfully fill out the Nyc 200v form.

- Click the ‘Get Form’ button to access the Nyc 200v form and open it in your preferred document editor.

- Begin by selecting the calendar year or fiscal year for which you are filing the form. This is important for aligning your tax obligations with the correct time period.

- Input the name of your business or the reporting corporation’s name if you are filing as a combined corporate filer. Include your employer identification number (EIN) in the designated field.

- Provide your first and last name along with your social security number in the appropriate sections if you are an unincorporated business or an individual.

- Enter the complete business address, including the number, street, city, state, and zip code.

- Fill in your business telephone number and email address. This information is necessary for communication regarding your submission.

- Indicate the tax type applicable to your payment by checking the appropriate box for the tax you are filing — options include General Corporation Tax, Banking Corporation Tax, and various Unincorporated Business Tax categories.

- Refer to your e-filed tax return or extension to determine the payment amount. Write this amount clearly in the payment section.

- Make your check payable to the NYC Department of Finance. Ensure that it is completed according to the payment instructions to avoid delays.

- Finally, review all provided information for accuracy. Once confirmed, you can save changes, download the completed form, and print or share it as needed.

Complete your Nyc 200v form online today to stay compliant with your tax obligations.

New York's income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350.

Fill Nyc 200v

NYC Official Payments via CityPay - Pay NYC directly for Parking and Camera violations, property taxes, business taxes, licenses and much more. The NYC-200V form serves as a payment voucher for individuals and businesses that owe taxes in New York City. Advised client that removing the banking information for direct debit would generate the voucher. You can make an estimated income tax payment with an Individual or Fiduciary Online Services account. See form NYC-200V for more information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.