Loading

Get Ia 126 Nonresident 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 126 Nonresident 2012 Form online

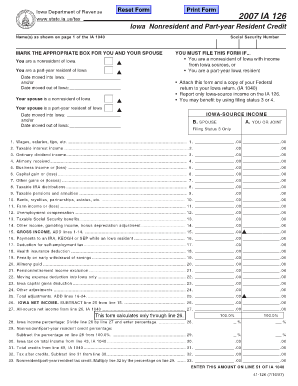

The Ia 126 Nonresident 2012 Form is essential for nonresidents and part-year residents of Iowa who have income from Iowa sources. By filling out this form correctly, you can ensure your tax obligations are met while potentially benefiting from tax credits.

Follow the steps to complete the Ia 126 Nonresident 2012 Form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your name as shown on your IA 1040 and your Social Security number in the designated fields.

- Indicate your residency status by marking the appropriate box to identify if you are a nonresident or a part-year resident of Iowa.

- If applicable, fill in the date you moved into or out of Iowa.

- Report your Iowa-source income by filling in each relevant field from line 1 to line 14, including wages, interest income, and business income.

- Add up the amounts reported on lines 1-14 to determine your gross income, and write the total on line 15.

- List any adjustments on lines 16-24 that apply to your situation. Calculate your total adjustments and write the sum on line 25.

- Subtract the total adjustments from your gross income on line 26 to determine your Iowa net income.

- Complete line 27 by reporting your all-source net income from your IA 1040.

- Calculate your Iowa income percentage on line 28 by dividing your Iowa net income by your all-source net income and expressing it as a percentage.

- On line 29, subtract the percentage from line 28 from 100% to find your nonresident/part-year resident credit percentage.

- Fill in the Iowa tax on total income from line 30 based on your IA 1040, and enter any total credits on line 31.

- Calculate the tax after credits by subtracting line 31 from line 30 and write the result on line 32.

- Multiply the amount on line 32 by the percentage on line 29 to determine your nonresident/part-year resident tax credit. Enter this amount on line 33.

- Once you have completed the form, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Ensure your tax documents are correctly completed online for efficient processing.

For tax years beginning on or after January 1, 2022, pass-through entities with nonresident members are required to file composite returns and pay composite return tax on behalf of its nonresident members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.