Loading

Get 92a204

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 92a204 online

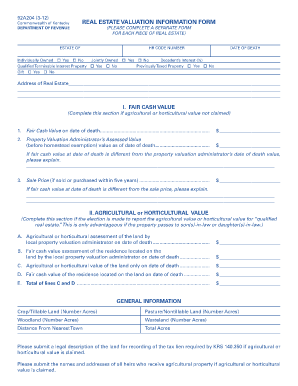

The 92a204 form is essential for providing real estate valuation information in Kentucky. This guide will help you navigate the online completion of the form, ensuring accuracy and compliance.

Follow the steps to successfully complete the form online.

- Select the ‘Get Form’ button to obtain the 92a204 document and access it for editing.

- Begin filling out the top section by entering the estate name, HR code number, and date of death. Ensure that all information is accurate.

- Indicate ownership status by selecting options for individually owned or jointly owned, and provide the decedent's interest percentage if applicable.

- Next, specify if the property falls under qualified terminable interest property or previously taxed property, along with details regarding any gifts.

- Complete the address section for the real estate, making sure to provide a detailed and complete address.

- Move on to section I, Fair Cash Value. If necessary, enter the fair cash value on the date of death and the property valuation administrator’s assessed value.

- If fair cash value differs from the assessment, provide a brief explanation in the designated area.

- Fill out the sale price if the property was sold or purchased within the last five years. Again, if discrepancies exist, explain them.

- For section II, Agricultural or Horticultural Value, provide the relevant assessments and fair cash values as applicable.

- Document the number of acres for different land types and provide the distance from the nearest town.

- Finish by submitting a legal description of the land and names and addresses of heirs if agricultural or horticultural value is claimed.

- Review all entries for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your form online today for a streamlined process.

Related links form

Downsize and donate the cash Another common tax loophole is to downsize your property. As inheritance tax only comes into effect at the time of someone's death, taking into account assets that have been given away in the seven years prior to death, it can be a good idea to downsize to a smaller property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.