Loading

Get Ri 1040 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri 1040 Form online

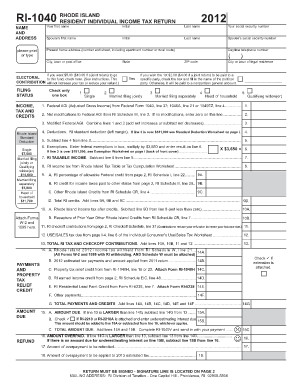

Filling out the Ri 1040 Form online can simplify your tax filing process. This guide provides clear and comprehensive steps tailored to help users navigate through each section of the form efficiently.

Follow the steps to successfully complete your Ri 1040 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your personal details: fill in your first name, initial, last name, and social security number. If applicable, include your spouse's first name, initial, last name, and social security number.

- Indicate your daytime telephone number for contact purposes.

- Enter your federal adjusted gross income (AGI) from your federal return in line 1. If there are any net modifications to your federal AGI, report those in line 2 to calculate modified federal AGI on line 3.

- Subtract the Rhode Island standard deduction based on your filing status from line 3 and report the result on line 5.

- Calculate your Rhode Island taxable income by subtracting line 6 from line 5, reporting the result on line 7.

- Complete the credit sections (9A, 9B, 9C) and total them to find total RI credits on line 9D.

- If you owe any amount or are due a refund, calculate it using lines 15A, 15B, and 16. Follow the instructions provided for any checkoff contributions and payments.

- Ensure you sign the form electronically and provide the date. Provide preparer's information if applicable.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Start completing your Ri 1040 Form online today to ensure a smooth tax filing experience.

Related links form

Order online. Use the 'Get Transcript ' tool available on IRS.gov. There is a link to it under the red TOOLS bar on the front page. ... Order by phone. The number to call is 800-908-9946. Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.