Loading

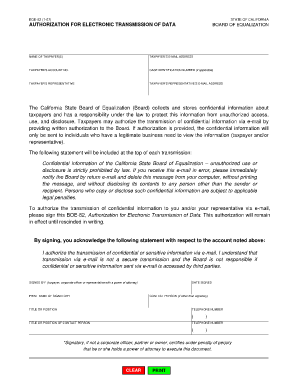

Get Authorization For Electronic Transmission Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authorization For Electronic Transmission Form online

Filling out the Authorization For Electronic Transmission Form is essential for taxpayers in California who wish to authorize the electronic transmission of their confidential information. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Authorization For Electronic Transmission Form and open it in your preferred online editor.

- Begin by entering the name of the taxpayer or taxpayers in the designated field. Ensure that the spelling is accurate as this information is critical.

- Fill in the taxpayer’s e-mail address. This should be an active e-mail account where correspondence can be securely sent.

- Next, provide the taxpayer’s account number. This number is necessary for identifying the taxpayer within the Board's records.

- If applicable, include the case identification number. This information is essential for cases involving specific tax issues and helps in tracking.

- Indicate the taxpayer’s representative, if one is designated. This could be an accountant or attorney acting on behalf of the taxpayer.

- Enter the e-mail address of the taxpayer’s representative to ensure they receive necessary communications.

- Read and acknowledge the statement regarding the nature of e-mail transmission, confirming your understanding of the risks involved.

- Sign the form in the appropriate section, indicating that you have the authority to authorize the transmission of sensitive information. Your signature confirms your approval.

- Print the name of the signatory along with the date when the form is signed.

- If applicable, provide the contact person’s details, including their title or position and telephone number. This step is useful for follow-up inquiries.

- Finally, review all the information for accuracy and completeness before saving the document or sharing it as needed.

Complete your Authorization For Electronic Transmission Form online today.

To complete the tax clearance online, go to our Online Services portal at .cdtfa.ca.gov, select the Login/Register tab, and then select the Request a Sales Tax Clearance function. Alternatively, you can submit a written request for a tax clearance to your local CDTFA office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.