Loading

Get Pdf W2 Filler Android Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pdf W2 Filler Android Form online

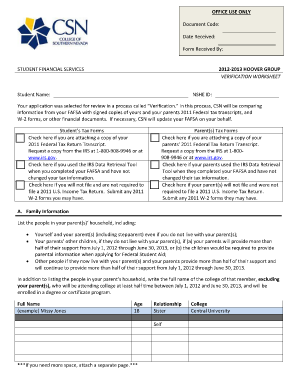

Filling out the Pdf W2 Filler Android Form is a crucial step in ensuring accurate financial reporting for your FAFSA verification process. This guide provides clear instructions on completing each section of the form online, tailored to assist all users, regardless of their prior experience.

Follow the steps to complete the Pdf W2 Filler Android Form online.

- Press the ‘Get Form’ button to access the Pdf W2 Filler Android Form, allowing you to open it in your document editor.

- Provide your personal information in the designated fields, including your name and NSHE ID, ensuring all details are accurate and up to date.

- Indicate whether you are attaching your 2011 Federal Tax Return Transcript by checking the appropriate box. If applicable, request this from the IRS.

- Complete the family information section by listing all people in your household, including parents and siblings. Be sure to include their ages and relationships.

- Fill in the income details for you and your parents if a Federal Income Tax Return was not required. List all employers and earned amounts for the year 2011.

- Answer the questions regarding untaxed income by reporting the annual amounts for various categories as outlined, ensuring each field is completed.

- Complete the additional financial information section, answering all questions regarding other sources of support or financial aid.

- Sign and date the form where required. Verify that all information is correct and complete before submission.

- Once the form is completed, you can save changes, download, print, or share the document as needed.

Start filling out your forms online today to ensure a smooth submission process.

View your W-2 Online If your employer has given you online access to access your pay information, log into login.adp.com. Note, not all companies use our online portal so if you are unable to log in, please contact your employer directly to ask about your W2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.