Loading

Get Schedule Wd Wisconsin 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Wd Wisconsin 2012 Form online

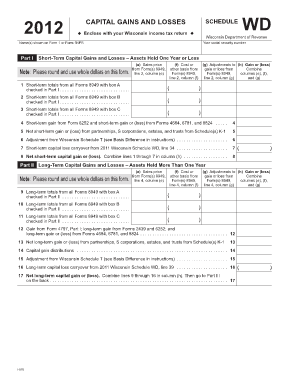

Filling out the Schedule Wd Wisconsin 2012 Form online is a straightforward process that helps users report capital gains and losses for tax purposes. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete your Schedule Wd Wisconsin 2012 Form online.

- Press the ‘Get Form’ button to access the Schedule Wd Wisconsin 2012 Form. This will enable you to open the document in your preferred digital editor.

- Begin by entering the name(s) of the individuals as shown on Form 1 or Form 1NPR at the top of the form. Additionally, input your social security number in the designated field.

- Complete Part I, which focuses on short-term capital gains and losses on assets held for one year or less. You will need to gather data from Form(s) 8949, detailing sales price, cost or other basis, adjustments to gain or loss, and summary totals as prompted by the form.

- Proceed to fill out each line in Part I, making sure to round and use whole dollars. Combine totals as required and enter results in the specified column (h).

- Move to Part II to address long-term capital gains and losses for assets held more than one year. Again, utilize information from Form(s) 8949, and follow the same process of rounding and combining as outlined previously.

- In Part III, summarize the results from Parts I and II. Record the net gain or loss, filling in any required calculations and moving through the various lines sequentially.

- Complete Part IV if you are filing on Form 1, following instructions related to adjustments to income. Accurate reporting here is essential for proper tax calculations.

- Finally, review all sections for completeness and accuracy. After confirming that the information is correct, save your changes, and you can then download, print, or share the completed form as needed.

Take the next step and fill out your Schedule Wd Wisconsin 2012 Form online today.

The IRS limits your net loss to $3,000 (for individuals and married filing jointly) or $1,500 (for married filing separately). Any unused capital losses are rolled over to future years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.