Loading

Get 2012 Wi Z Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Wi Z Tax Form online

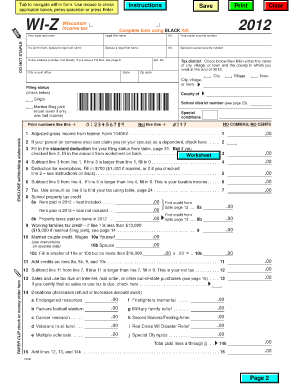

Completing the 2012 Wi Z Tax Form online can simplify your filing process and ensure accuracy. This guide will walk you through each step necessary to fill out the form correctly, making the process as straightforward as possible.

Follow the steps to complete your form effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your legal last name, first name, and middle initial in the respective fields. This ensures your identification matches the information on file with the tax authorities.

- Provide your social security number. If you are filing a joint return, repeat this step for your spouse's legal last name, first name, middle initial, and social security number.

- Complete your home address including the street number, city, state, and zip code. If you use a P.O. Box, follow the additional instructions indicated on the form.

- Select your filing status by checking the appropriate box. If applicable, also check if someone can claim you or your spouse as a dependent.

- Fill in your adjusted gross income as reported on your federal Form 1040EZ. Remember to enclose any withholding statements.

- If you checked the box indicating you can be claimed as a dependent, follow the instructions to determine the standard deduction amount and fill it in.

- Calculate your taxable income by subtracting any deductions from your gross income.

- Complete tax calculations using the appropriate tax tables provided in the form instructions.

- If applicable, fill out any tax credits you may be eligible for based on your circumstances, such as school property tax credits or working families tax credit.

- Add any credits and subtractions to determine your net tax due or refund.

- Finally, review the entire form for accuracy. You can then save your changes, download, print, or share the form as needed.

Complete your documents online today for a more efficient filing experience!

Wisconsin is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.65%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.