Loading

Get 2012 N 288a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 N 288a Form online

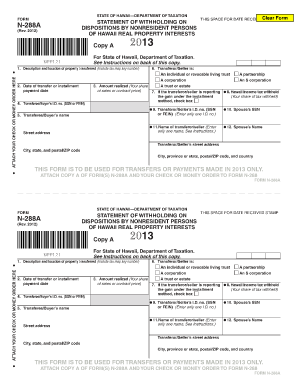

The 2012 N 288a Form is a crucial document for reporting withholding on dispositions by nonresident persons of Hawaii real property interests. This guide offers a clear and supportive walkthrough on how to complete the form online, ensuring users understand each component.

Follow the steps to fill out the 2012 N 288a Form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- In Box 1, enter a description and location of the property transferred, including the tax map key number.

- In Box 2, input the date of the transfer or the payment date if it is an installment.

- In Box 3, record the amount realized, which is your share of the sales or contract price.

- In Box 4, enter the identification number of the transferee/buyer (either SSN or FEIN).

- In Box 5, provide the name of the transferee/buyer.

- In Box 6, check the applicable box to indicate the classification of the transferor/seller (individual, partnership, corporation, etc.).

- If relevant, check the box in Box 7 to indicate if the transferor/seller will elect out of the installment method.

- In Box 8, record the amount of Hawaii income tax withheld.

- In Box 9, enter the transferor/seller’s identification number (either SSN or FEIN).

- In Box 10, if filing jointly, include the spouse’s SSN.

- In Box 11, enter the name and address of the transferor/seller.

- In Box 12, if applicable, enter the spouse’s name.

- Review the completed form thoroughly for accuracy before finalizing.

- Once completed, you can save your changes, download, print, or share the form as needed.

Complete the 2012 N 288a Form online today to ensure accurate reporting of real property dispositions.

“Every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business." Every individual receiving more than the allowed amounts of gross income listed below, must file a Hawaii state return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.