Loading

Get Form 5 Wisconsin 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5 Wisconsin 2012 online

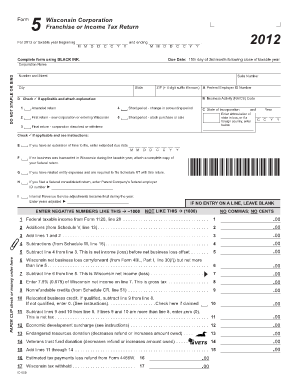

Filling out the Form 5 Wisconsin 2012 is essential for corporations reporting their franchise or income tax. This guide provides clear, step-by-step instructions to simplify the online filling process, ensuring accuracy and compliance.

Follow the steps to complete the Form 5 Wisconsin 2012 online

- Click ‘Get Form’ button to access and open the form in an online editor.

- Provide your corporation name in the designated field.

- Enter your business address, including street number, suite number, city, state, and ZIP code.

- Input your Federal Employer Identification Number (FEIN) in the appropriate section.

- Fill in the Business Activity Code (NAICS) that corresponds to your corporation's primary activity.

- Check any boxes that apply to your situation, such as if this is an amended return or the first return for a new corporation.

- Indicate the state of incorporation by entering the abbreviation, or the name of the foreign country if applicable.

- If you have extensions, fill in the extended due date in the space provided.

- If no business was transacted in Wisconsin, attach a complete copy of your federal return as instructed.

- Proceed to complete the income and tax calculation sections, entering figures as they apply to your corporation's finances, ensuring to leave blank any non-applicable lines.

- Review the calculations for tax, credits, and any payment due or refund expected.

- Finalize the form by providing necessary signatures and dates, and ensure that all attachments are included.

- Once finished, you can save your changes, download, print, or share the filled form as needed.

Start completing your Form 5 Wisconsin 2012 online today to meet your filing requirements.

You may electronically file your return by either of the following methods: My Tax Account. The department's online filing and payment system. You will need a username and password. See: Using My Tax Account. Telefile. The department's telephone filing and payment system. Call (608) 261-5340 or (414) 227-3895.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.