Loading

Get Form Gr 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form GR-1040 online

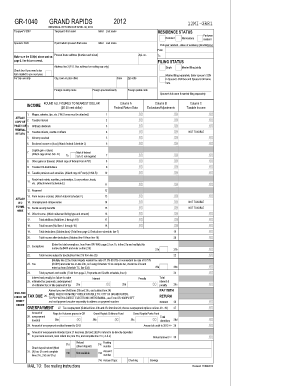

Filling out the Form GR-1040 online is a straightforward process designed to simplify your tax return submission for residents of Grand Rapids. This guide provides step-by-step instructions to ensure that you complete each section accurately and efficiently.

Follow the steps to fill out the Form GR-1040 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the Taxpayer's section. Include your first name, last name, and Social Security Number (SSN). If you're filing jointly, provide your spouse's information as well.

- Indicate your residence status by selecting whether you are a resident, nonresident, or part-year resident. If part-year resident, specify the dates of residency.

- Move to the income section where you will report all sources of income. Input amounts for wages, business income, capital gains, and other income. Ensure to round all figures to the nearest dollar.

- Calculate your total income by adding all amounts listed in the income section. This is crucial as it affects your taxable income.

- Enter any deductions you are eligible for in the deductions section. This includes adjustments like IRA and business expense deductions. Be sure to refer to any corresponding schedules if necessary.

- After deductions, calculate your total income after deductions. Follow the prompts to determine your taxable income and tax due based on Grand Rapids tax rates.

- If you have overpayments, indicate how you would like these to be handled. You can choose to receive refunds or credit them towards the next year’s taxes.

- Complete the required signatures and check the corresponding boxes for direct deposit refunds if applicable.

- Once all sections are filled out correctly, review your form for accuracy. Save your changes and opt to download, print, or share the finished document as needed.

Get started and complete your Form GR-1040 online for a hassle-free filing experience.

Form 1040 is how individuals file a federal income tax return with the IRS. It's used to report your gross income the money you made over the past year and how much of that income is taxable after tax credits and deductions. It calculates the amount of tax you owe or the refund you receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.