Loading

Get W4 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 2013 online

Filling out the W4 2013 form online can be straightforward with the right guidance. This comprehensive guide provides you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the W4 2013 form seamlessly.

- Click 'Get Form' button to access the W4 2013 form and open it in your preferred online editor.

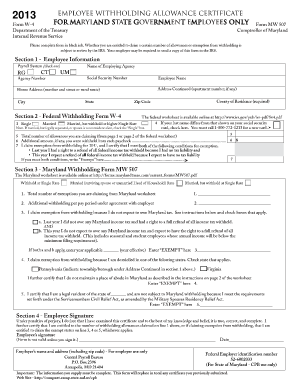

- Begin by filling out Section 1 - Employee Information. Enter your name, address, and Social Security number as instructed. Make sure to provide accurate details, including your agency number and county of residence.

- Move to Section 2 - Federal Withholding Form W-4. Indicate your filing status by selecting either 'Single,' 'Married,' or 'Married, but withhold at higher Single Rate.' If your last name differs from that on your Social Security card, check the appropriate box and follow the guidance provided.

- Specify the total number of allowances you are claiming and any additional amount you wish to have withheld from each paycheck. If you claim exemption from withholding, ensure you meet the specified conditions and write 'Exempt' in the designated field.

- Proceed to Section 3 - Maryland Withholding Form MW 507. Indicate your exemptions as claimed on the Maryland worksheet. You may also specify any additional withholding per pay period.

- In this section, check the appropriate boxes to claim exemption from withholding if applicable. Provide the year applicable for your exemption claim and enter 'Exempt' where indicated.

- Complete Section 4 - Employee Signature. Under penalties of perjury, declare that the information provided is true and complete. Sign the form to validate it. Keep in mind that the form is not valid without your signature.

- Once all sections are complete, review the form for accuracy. Save any changes made, and you can then download, print, or share the completed form as necessary.

Get started on completing your W4 2013 form online today.

Related links form

No. Only new employees whose first paycheck is in 2020 must use the new W-4 form. Be sure to distribute the correct form to your new hires. Employees must fill out the 2020 version of the form if they decide to change their withholdings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.