Loading

Get 1993 1099 Oid Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1993 1099 Oid Form online

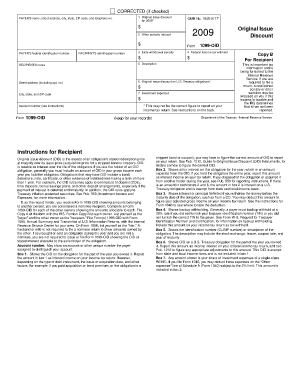

The 1993 1099 Oid Form is essential for reporting original issue discount income. This guide will walk you through the steps to accurately complete this form online, ensuring you adhere to all requirements.

Follow the steps to fill out the 1993 1099 Oid Form online.

- Click the 'Get Form' button to download the 1993 1099 Oid Form and open it in your preferred online editor.

- Enter the payer's name, street address, city, state, ZIP code, and telephone number in the designated fields at the top of the form.

- Input the payer's federal identification number in the corresponding box to ensure accurate reporting.

- Fill in the recipient's identification number to identify the person receiving the income.

- Complete Box 1 by entering the amount of original issue discount for the portion of the year you owned the obligation.

- Record any other periodic interest in Box 2 that is separate from the original issue discount.

- If applicable, indicate any early withdrawal penalty in Box 3, particularly if you withdrew funds before the maturity date.

- Include any federal income tax withheld in Box 4, if relevant.

- Provide the description and identification number for the obligation in Box 5.

- If applicable, enter the original issue discount on U.S. Treasury obligations in Box 6.

- For any investment expenses incurred, fill in Box 7 with the amount related to those expenses.

- Review all entries for accuracy before saving your form, then download, print, or share the completed document as needed.

Start completing your 1993 1099 Oid Form online today to ensure accurate reporting.

Starting with the first box labeled PAYER'S name etc.: Enter the BORROWER'S information (NAME, ADDRESS, ETC) as recorded on your Form 1099-A. PAYER'S federal ID #: Leave blank unless known. RECIPIENT'S ID #: Enter your SSN in standard form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.