Loading

Get Seller Residency Certificationexemption C 55 Pl 2004 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Seller Residency Certification exemption C 55 Pl 2004 Form online

This guide provides a comprehensive overview for users on how to complete the Seller Residency Certification exemption C 55 Pl 2004 Form online. By following the steps outlined, users can efficiently fill out the necessary information and ensure compliance with New Jersey tax regulations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Seller Residency Certification exemption C 55 Pl 2004 Form.

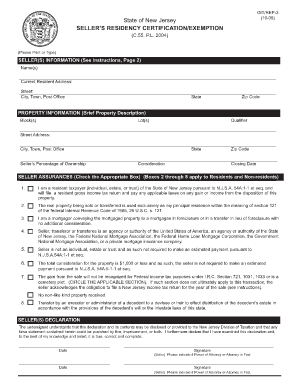

- Enter the seller(s) information. Fill in the name(s) of the seller(s) in the designated fields. Ensure that the current residential address, including street, city, state, and zip code, is accurate and reflects the primary residence of the seller(s).

- Provide property information. Enter the block and lot numbers as well as the street address of the property being sold. Include the percentage of ownership and the total consideration amount.

- Select the seller assurances. Check the appropriate boxes that apply to the seller's situation. Ensure that you only check the boxes that match the criteria relevant to the transaction.

- Complete the seller(s) declaration. Both sellers must sign the declaration confirming that the information provided is true and complete. If a power of attorney is used, indicate this appropriately and attach any necessary documents.

- Review all entries. Before finalizing the form, double-check for completeness and accuracy to avoid delays in processing.

- Save your changes after completing the form. You may also download, print, or share the filled form based on your needs.

Complete your Seller Residency Certification exemption C 55 Pl 2004 Form online today to ensure a smooth transaction process.

Related links form

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.