Loading

Get Instructions For Filing Reconciliation Of Income Tax Withheld

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Filing Reconciliation Of Income Tax Withheld online

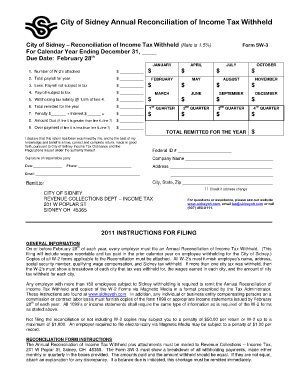

This guide provides a clear, comprehensive approach for users to complete the Instructions For Filing Reconciliation Of Income Tax Withheld online. By following these steps, you will ensure accurate reporting and compliance with local tax regulations.

Follow the steps to successfully complete your tax reconciliation form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Review the general information section, which provides essential details on filing deadlines and required attachments, including W-2 forms.

- Enter the number of W-2s you are attaching to the reconciliation in the designated field.

- Input your total payroll for the year in the respective space.

- Subtract any payroll not subject to tax from your total payroll and enter the amount in the appropriate line.

- Determine your payroll subject to tax by entering the amount on the designated line.

- Calculate your withholding tax liability at a rate of 1.5% of the payroll subject to tax and record this in the specified area.

- Document the total amount remitted for the year in the corresponding section.

- If applicable, calculate any penalties and interest due, and include the totals in the designated fields.

- If the withholding tax liability exceeds the total amounts remitted plus penalties and interest, calculate the amount due and record this amount.

- If your remitted amounts exceed your liability, calculate the overpayment and include this amount.

- Complete the responsible party declaration, entering the necessary details such as the name of the business, federal ID number, and contact information.

- After reviewing all entries for accuracy, save your changes, and consider options to download, print, or share the completed form as required.

Complete your documents online today to ensure timely and accurate filing.

Related links form

Solution: The statement of financial position. The statement of profit or loss and other comprehensive income. The income tax return (or detailed calculation of current income tax) The detailed calculation of the deferred tax asset or liability as of the end of the previous reporting period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.