Loading

Get 1040me

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040me online

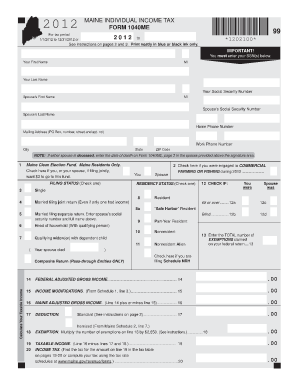

The 1040me form is essential for Maine residents to report individual income and calculate tax obligations. This guide provides a clear and actionable process for completing the form online, ensuring you can fulfill your tax responsibilities with confidence.

Follow the steps to accurately complete the 1040me form online.

- Press the ‘Get Form’ button to obtain the 1040me form and access it in the online editor.

- Begin by entering your personal information, including your first name, middle initial, last name, and Social Security Number. Make sure to input information accurately to avoid processing delays.

- If applicable, provide the same information for your spouse, including their Social Security Number. Ensure both names are clearly printed.

- Proceed to record your home and work phone numbers, along with your mailing address. This information helps the authorities to contact you if necessary.

- Check the box for the Maine Clean Election Fund if you wish to contribute a small amount to this fund.

- Select your filing status by checking the appropriate box indicating whether you are single, married filing jointly, married filing separately, head of household, etc.

- Enter the total number of exemptions claimed on your federal return.

- Input your Federal Adjusted Gross Income and make any necessary modifications from the provided schedules.

- Calculate your Maine Adjusted Gross Income by combining your Federal Adjusted Gross Income with any income modifications.

- Record your deduction, either itemized or standard, based on the relevant schedules or instructions.

- Determine your taxable income by subtracting the total deductions from your Maine Adjusted Gross Income.

- Calculate your income tax based on your taxable income, using the tax table provided or calculating according to the tax rate schedules.

- Fill out any additional tax credits, additions, or refundable credits as applicable.

- Review all entries for accuracy. After confirming everything is correct, proceed to save your changes and download the form.

- Finally, you can print or share the completed form to ensure timely submission to Maine Revenue Services.

Start filling out your 1040me form online today to ensure accurate tax reporting!

While there is no federal inheritance tax, six states: Nebraska, Iowa, Kentucky, New Jersey, Pennsylvania, and Maryland, do implement a state inheritance tax. This tax rate varies based on where you live and the size of the inheritance. For example, Nebraskans might pay as much as an 18% tax on inheritances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.