Loading

Get California 540nr 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California 540nr 2012 Form online

Filling out the California 540nr 2012 Form can be a straightforward process when done online. This guide provides clear, step-by-step instructions for each section of the form, ensuring that you can complete it accurately and efficiently.

Follow the steps to fill out the California 540nr 2012 Form online.

- Click ‘Get Form’ button to obtain the California 540nr 2012 Form and open it in your preferred online editor.

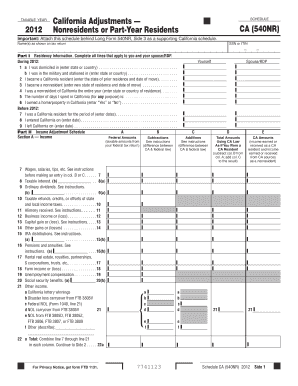

- Begin with Part I, Residency Information. Fill in all applicable lines for yourself and your spouse/partner, including details on your domicile, military service, and residency changes.

- Next, move to Part II, Income Adjustment Schedule. In Section A, input your federal amounts for wages, interest, dividends, and other income, followed by any subtractions or additions required.

- Continue to Section B of Part II to enter any adjustments related to federal itemized deductions, ensuring to accurately input each relevant deduction.

- Progress to Part III for any additional adjustments to federal itemized deductions per the instructions, making sure all calculations are precise.

- Finally, complete Part IV, California Taxable Income. Enter your California Adjusted Gross Income, deductions, and calculate your taxable income by following the formula provided.

- Once all sections are filled, save your changes. You can then download, print, or share the completed California 540nr 2012 Form as needed.

Get started on completing your California 540nr 2012 Form online today!

Related links form

The State of California taxes its residents on all of their income, including income acquired from sources outside the state. Nonresidents are also subject to California income tax, but only on their California-source income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.