Loading

Get 2012 Form 990 Schedule M

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 990 Schedule M online

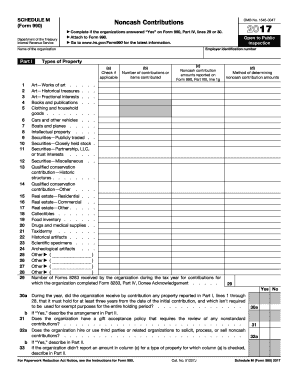

Filing the 2012 Form 990 Schedule M is essential for organizations reporting noncash contributions. This guide provides a clear and concise approach to completing the form online, ensuring that users can accurately document their contributions.

Follow the steps to successfully complete your Form 990 Schedule M

- Click ‘Get Form’ button to access the 2012 Form 990 Schedule M and open it in your online editor.

- Begin by entering your organization's employer identification number and name at the top of the form.

- Navigate to Part I, where you will categorize and detail the types of noncash contributions received. For each type of property listed, check the applicable box in column (a).

- In column (b), enter the number of contributions or items contributed based on your organization’s recordkeeping practices. Clarify in Part II whether you are reporting the number of contributions or items.

- For column (c), input the noncash contribution amounts as reported on Form 990, Part VIII, line 1g. If there are no contributions for a type, enter '0'.

- In column (d), specify the method used to determine the noncash contribution amounts, such as cost or selling price of donated property.

- Proceed to Part II for supplemental information, providing any necessary narrative details regarding the noncash contributions reported in Part I.

- After completing the form, review all entries for accuracy. You can then save changes, download the completed form, or print it for future reference or submission.

Complete your Form 990 Schedule M online for accurate documentation of your noncash contributions.

Schedule I (Form 990) is used by an organization that files Form 990 to provide information on grants and other assistance made by the filing organization during the tax year to domestic organizations, domestic governments and domestic individuals. Report activities conducted by the organization directly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.