Loading

Get 2012pit 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 PIT-1 Form online

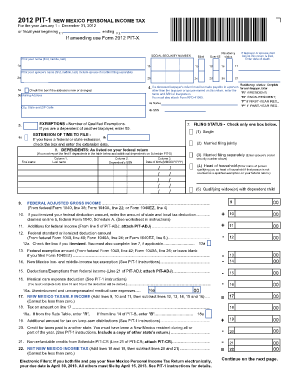

Filling out the 2012 PIT-1 form is an essential step for individuals to report their personal income tax in New Mexico. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to successfully complete your form.

- Press the ‘Get Form’ button to access the 2012 PIT-1 Form and open it in the online editor.

- Begin by entering your social security number in the designated field. Ensure that this information is accurate to avoid processing issues.

- Indicate your residency status by selecting 'R' for resident, 'N' for non-resident, 'F' for first-year resident, or 'P' for part-year resident. This information is crucial for determining your tax obligations.

- If applicable, check the box indicating if you are blind or over 65 years old. These details may influence your tax exemptions.

- Provide details about any dependents you claim on your tax return. Include their first name, last name, social security number, and date of birth in the fields provided.

- Enter your federal adjusted gross income as reported on your federal tax return. This figure will guide the calculation of your New Mexico taxable income.

- Calculate total payments and credits by adding up any tax credits or payments you have made. This amount should be recorded accurately to reflect your financial situation.

- Review all the entries for correctness. Ensure that all necessary information has been provided and that there are no typographical errors.

- Once satisfied with your entries, you can save your changes, download, print, or share the completed form electronically as needed.

Complete your 2012 PIT-1 Form online today and ensure your tax obligations are met.

The pass-through entity tax is not so much a separate tax but rather a mechanism designed to collect individual income tax or corporate franchise tax which is oth erwise due and payable by pass-through entity in vestors pursuant to Ohio tax law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.